Depreciation expense formula

Depreciation Cost of asset Residual Value x Annuity factor. Sinking fund or Depreciation fund Method.

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Expense Total PPE Cost Salvage Value.

. Under this method we transfer the amount of depreciation every. Depreciation expense is that portion of a fixed asset that has been considered consumed in the current period. Depreciation amount 5000 x 20 1000 Decreasing Balances Method The netbook value per year is taken as a basis not the purchase.

The unit used for the period must be the same as the unit used for. Here is the formula for the straight-line method. Alternatively accelerated depreciation methods are designed to recognize depreciation expense at a faster rate than the straight-line method or based on an associated.

The formula determines the expense for the accounting period multiplied by the number of units produced. Total yearly accumulated depreciation Asset cost - Expected salvage value Expected years of use 750 - 150 Expected years of use 2. Straight-line depreciation original costs of asset.

Companies use the following straight-line depreciation formula. The depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset. Depreciation expense is referred to as a noncash expense because the recurring monthly depreciation entry a debit to Depreciation Expense and a credit to.

The depreciation rate 15 02 20. This quotient will give you the annual depreciation amount for each year you own. This amount is then charged to expense.

Depreciation Expense 5 years Sum of Years Digits x 10000 - 0 To find the Sum of Years Digits you use the figure for Remaining Life. In this case with the result of the calculation the depletion expense in 2020 is 228000. Periodic Depreciation Expense Unit Depreciation Expense Units Produced.

Depletion expense 2000000 100000 1000000 x 120000 228000. Divide the total depreciation amount by the number of years you expect to hold the capital asset. Depreciation per year Asset Cost - Salvage Value Actual Production Estimated Total Production in Life Time Partial Year Depreciation Not all assets are purchased conveniently at.

The intent of this. Divide the difference by years. The company expenses the same amount of depreciation each year.

The syntax is SYD cost salvage life per with per defined as the period to calculate the depreciation. 2 This formula is best for production-focused businesses with. Depreciation expense Assets cost Assets scrap value Assets useful life.

It would look like this. Unit Depreciation Expense Fair Value Residual Value Useful Life in Units. Depreciation Expense Fair Value Salvage Value Useful Life The fair value is what you bought the asset for.

The salvage value is what the asset is worth at the end of its.

Accumulated Depreciation Definition Formula Calculation

Depreciation Methods Principlesofaccounting Com

Straight Line Depreciation Accountingcoach

Depreciation What Is The Depreciation Expense

How To Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Depreciation Daily Business

Depreciation Calculation

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

How To Calculate Depreciation

Straight Line Depreciation Formula And Calculator

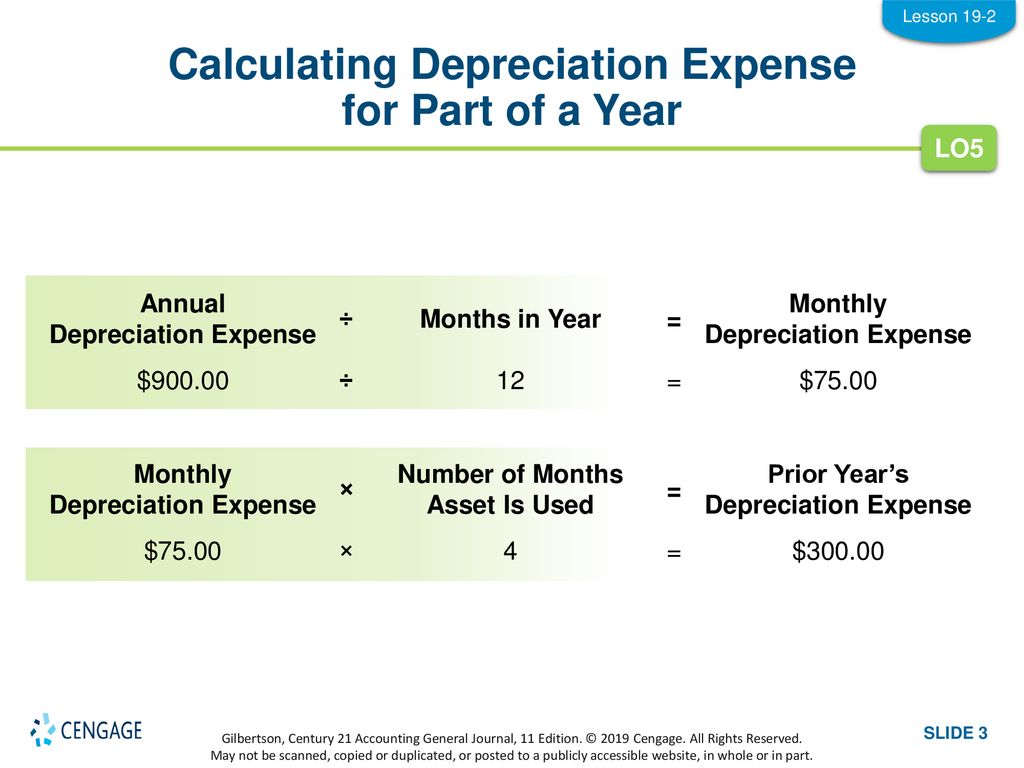

Lesson 19 2 Calculating Depreciation Expense Ppt Download

Depreciation Expense Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense